FUNDING MODEL

With a well defined program model and evaluation approach, CityLink and our partners have seen tremendous client progress. As the partnerships grew to create more opportunities for more neighbors, one constraint remained, responsive funding for scalable program partner growth.

As we wrestled with funding for socio-economic mobility, we realized that CityLink was an ideal ecosystem to test a new funding approach.

By exploring and testing a new funding model, we hope to drive flexibility, scalability and accountability to better serve our neighbors. Let's first explore how the Stakeholder Gap impacts our sector, then explore how our Aligned Investment Pilot as a solution.

A disconnect exists between client outcomes and program income.

This gap exists in the nonprofit sector because "the people in the best position to assess whether the organization is actually creating value (our clients) - are not the same people who deliver the financial resources that all modern nonprofits need to survive".

This disconnect of outcomes and income create significant downstream ramifications on the sector, issues we want to resolve.

STAKEHOLDER GAP

1

RAMIFICATIONS OF THE STAKEHOLDER GAP

-

Programs Lack Scalability: Social service budgets are typically fixed on an annual basis, limiting the freedom and flexibility to invest in new opportunities which could accelerate outcomes. In a rapidly changing external environment where employer and even industry needs shift within the fiscal year, this model is particularly limiting. Existing grant timing and cycles inherently limit responsiveness.

The stakeholder gap causes our sector can struggle on multiple levels:

-

Programs Lack Flexibility: Lack of financial flexibility does not allow practitioners to remove unique individual barriers as they are encountered. For example, license reinstatement fees are a critical requirement for securing a job. Transportation barriers or potential eviction can derail progress. Each individual may have a unique barrier to successfully engage or achieve outcomes.

-

Investments Lack Accountability: Investment in human services is based on past performance, perceived potential, and promise of future performance, however there is often no direct link between funding and outcomes. Nonprofits can struggle to scale what is working due to the lack of alignment while legacy programs may have funding to continue less effective programs. The lack of connectivity of funding to outcomes can stifle growth, innovation, and impact.

Jim Collins' Flywheel concept illustrates that how consistent activities if done right over time can drive your organizational and economic engine to sustainably grow. Better customer service and products, lead to more customers, subsequent revenue, to re-invest in the business. In the non-profit sector there is no direct connection between income and outcomes, distorting our sector.

This is not a mantra to run non-profits like businesses, it is simply a call to explore the operating conditions of the non-profit sector which may inhibit our capacity to effectively scale solutions.

Explore more about the dynamic's impact on our operations here.

WHERE IS THE FLYWHEEL?

A NEW SOLUTION

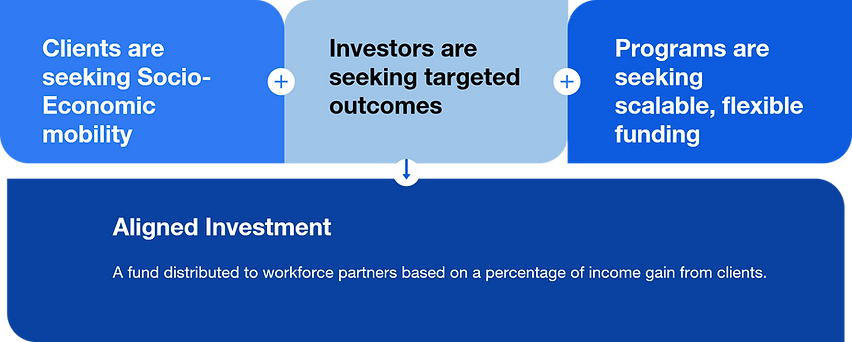

Taking a step back, we sought to understand the goals of each of our stakeholders, then align those goals, the result is a funding pilot, "Aligned Investment".

The Aligned Investment Fund ties program income to client outcomes, distributing funds to program partners quarterly based on client income gain. The approach closes the stakeholder gap. The pilot gives flexibility and scalability to increase responsiveness and improve outcomes while simultaneously driving accountability.

We are extremely grateful to our funding partners for launching this pilot in partnership with us:

Farmer Family Foundation, Crossroads Church, MercyHealth, Greater Cincinnati Foundation, and the Klekamp family.

The fund construct is a simple yet powerful approach to accelerate economic-mobility.

-

Investors made a 3-year commitment, contributing to the fund on an annual basis, reviewing and providing feedback on the learning journey

-

Fund Manager raises and manages the fund; manages the outcome data, reporting, and quarterly distribution to program partners

-

Program Partners manage their programs, responsible for client outcomes, investing dollars where they believe the greatest impact can be made on their program and client outcomes

BENEFITS

In Year 1 of the pilot, clients experienced $1.2MM of incremental wage gain which resulted in $187k payout to our program partners. Beyond the financial gains, the pilot delivered tremendous value to investors, program partners, our collaborative, and most importantly, our clients.

-

Client Barriers Addressed:

Specific client barriers can be addressed as they arise. Practitioners must discern if the barrier is critical to long-term success but can invest appreciating that the expense will be offset by future program income. Funds have been used for license reinstatement, rent, security deposits, cell-phone bills, gas cards and more.

-

Programs Have Flexibility:

Organizations will have the capacity to invest in addressing constraints, like recruiting. The collaborative utilized funds for an outbound strategy that resulted in a 30% increase in client volume.

-

Programs Have Scalability:

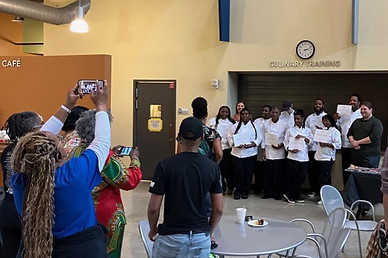

Funding enables programs to expand (and contract) with market demands and outcomes. Our culinary training expanded from 6 to 8 cohorts, increasing capacity by 30%.

Auto Tech training leveraged funds to also increase their program capacity by 30%

-

Every Dollar Expended for Targeted Outcome

Dollars are only distributed from the fund for the outcomes achieved. $1.2MM of increased earnings for a targeted client population were achieved through $187k of investment.

WHAT'S NEXT

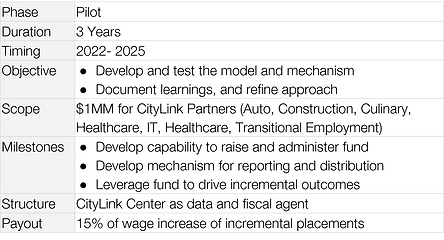

We are in the midst of a 3-year pilot, from which we will build a Limited Launch that expands to up to 5 workforce centers.

During the pilot we will continue to document our lessons learned, where the model has succeeded and what improvements need to be made.

This model has the potential to transform our sector's capacity to expand and better serve our neighbors. We will run after this approach and welcome the community of practitioners and funders to join us in strengthening and expanding the approach.

The 3-year pilot will conclude in 2025, at which point the organization is seeking partners for a subsequent Limited Launch to test and further refine the approach.

If you are a workforce hub or an investor interested in learning more and continuing the learning journey, please contact us.

NEXT STEPS

SHAPE OUR SECTOR

Help us take a pilot beyond our city limits to scale socio-economic mobility. Test and develop the funding model in a limited launch with us.

1

Praxis Partners, "The Redemptive Nonprofit - A Playbook for Leaders," 9.